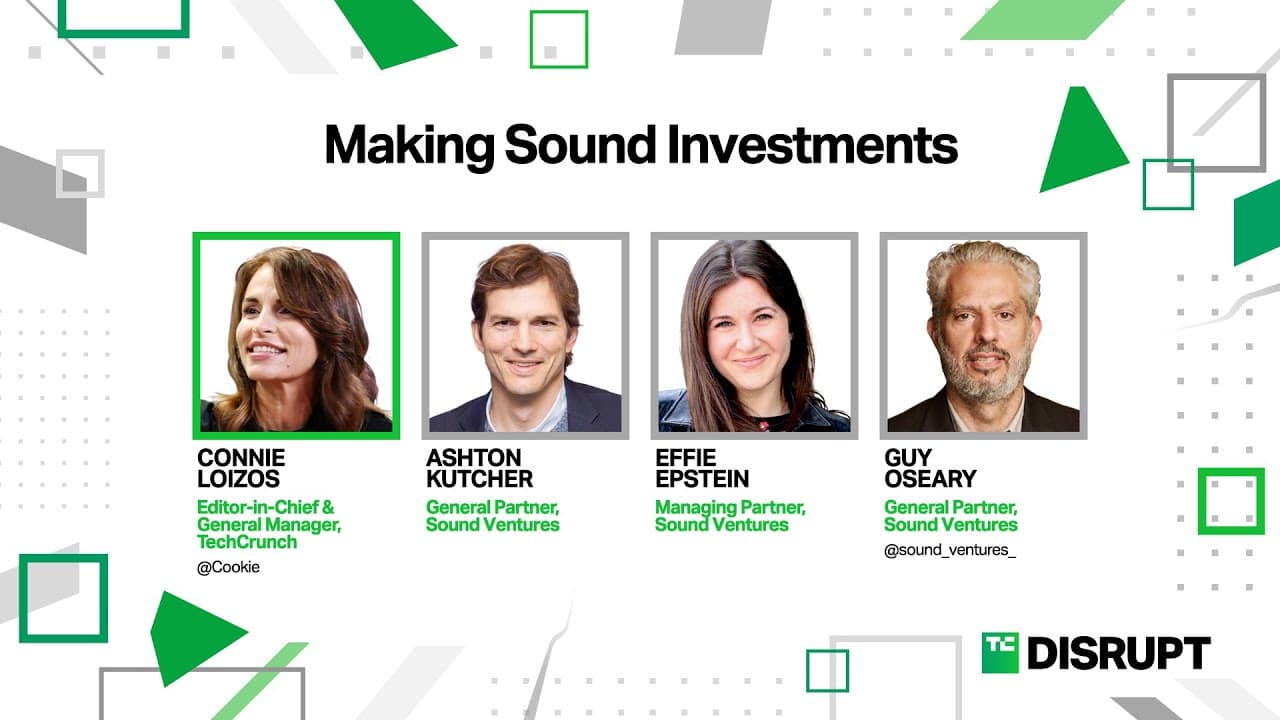

Making sound investments in 2024 with Ashton Kutcher | TechCrunch Disrupt 2024

30 Oct 2024 (1 year ago)

Ashton Kutcher's Investment Firm and Partnership

- Ashton Kutcher and his partner have been working together for nearly a decade, having initially met while exploring startup investments and deciding to team up. Their partnership is built on trust and mutual understanding, which was solidified over a year of collaboration before officially joining forces. (38s)

- The investment firm, which Ashton Kutcher is a part of, manages a billion dollars and has established itself as a serious player in the investment world by backing successful consumer product companies like Airbnb, Uber, Spotify, and Robinhood. (2m13s)

- The firm also invests in other sectors, such as digital health, exemplified by their investment in Form Health, a company that provides clinical weight loss solutions for employees through employers. This investment was sourced by a team member named Juliet, who recognized the potential of the company's data-driven approach. (2m52s)

Form Health Investment and Data-Driven Approach

- Employees are engaged in personalized health, nutrition, and fitness programs, with the efficacy of these programs being tracked and captured into a data trove. (3m32s)

- The company operates in the GP1 space, which is considered the backbone of pharmaceutical revenues, and has developed a unique proprietary data set that creates a persistent data loop. (3m56s)

- The combination of this data set with new AI breakthroughs is seen as a valuable asset and a potential competitive advantage for the future. (4m45s)

Sound Investment Fund's Strategies

- The investment fund, Sound, has two strategies: a Flagship early-stage vehicle writing $10 to $15 million checks, and thematic funds that are stage-agnostic, such as the AI growth thematic fund with $50 million checks. (6m6s)

- Sound is focused on founder-market fit, investing in founders who are passionate about solving specific problems. (6m36s)

- Marketing and narrative are crucial, with a focus on identifying and supporting talented founders, likened to finding and promoting rock stars in the music industry. (6m50s)

Working with Companies and Founder Focus

- The process of working with companies involves identifying talent quickly and helping them reach an audience through strategies like marketing and narrative development. The initial questions for founders focus on their vision, needs, and the key factors that could significantly increase their company's value. (7m30s)

- There is an emphasis on the importance of flexibility in thinking for founders, described as "up thinking," where extraordinary founders see beyond the obvious choices and explore innovative directions. (8m48s)

- Founders should possess extraordinary domain expertise in their field, demonstrated by a deep understanding of their industry and a willingness to learn and address any gaps in their knowledge. (9m29s)

- The company values the influence of relationships and the pedigree of investors. The reputation and recommendations from respected investors and founders can impact the perception and evaluation of a company, similar to how personal recommendations influence dating. (10m23s)

- Founders are advised to clearly articulate their vision and avoid staying in an echo chamber, as investors often leave pitches unsure of what is being built or the problem being solved. Testing the pitch on someone unfamiliar with the product can provide valuable insights. (11m30s)

- Knowing key business metrics, such as total addressable market (TAM), churn rate, and net revenue retention, is crucial for founders. This knowledge is likened to a parent understanding their child's needs, emphasizing the importance of being well-informed about one's business. (12m9s)

- The presence of a unique and compelling element, or "magic," in a pitch is important. This is compared to the memorable impact of hearing a great song for the first time. Founders should focus on creating a narrative that captures this magic, as seen in successful companies like Airbnb and Uber. (13m12s)

Importance of Storytelling and Vision

- The discussion emphasizes the importance of storytelling in presenting a vision, highlighting Sam Altman as a notable storyteller in Silicon Valley. (15m10s)

- A mix of institutional investors and family offices, many of which are institutional, are involved in the AI-focused fund raised last year. (15m35s)

AI-Focused Fund and Investments

- The fund includes investments in companies such as OpenAI, Anthropic, Stability AI, Hugging Face, World Labs, and Magic. (15m57s)

- Investing in multiple competitors is discussed, which was traditionally uncommon in venture capital, but is now more accepted. (16m16s)

- A long-standing relationship with Sam Altman is maintained, and an agreement was reached to invest in competitors without issues. (16m31s)

Value Added by Investors and Maintaining Privacy

- The value added by the investors is differentiated, particularly in media rights and data, which are crucial in the industry. (17m31s)

- The importance of maintaining privacy and not sharing information across companies is emphasized, with insights being valuable in the AI space. (18m16s)

Potential of AI and Converging/Differentiating Approaches

- There is a belief in the potential of the AI space, acknowledging that there might not be a single winner in the industry. (18m41s)

- Companies are both converging and differentiating in their approaches to AI and AGI, focusing on what makes them unique and what they excel at compared to others. This involves various benchmarks and support in areas like branding, media relationships, strategic conversations, financing, and talent acquisition, all aimed at benefiting society if AGI becomes widespread. (19m1s)

- The focus is on adding value to companies by identifying the right ones, gaining access, and winning deals, with an emphasis on supporting companies as they grow. This approach is seen as crucial for success in the industry. (20m10s)

Foundational AI Models and Investment Strategy

- The belief is that foundational AI models will underpin everything in the future, similar to how e-commerce strategies are essential for commerce companies today. The expectation is that every company will eventually integrate AI into their operations. (20m57s)

- The investment strategy includes both open-source AI, such as Hugging Face, and closed systems like Anthropic and OpenAI, as these technologies are expected to be the foundation of future developments. (21m45s)

- The evolution of AI is compared to the mobile revolution, where initially there were multiple operating systems, but eventually, a duopoly emerged with Android and iOS dominating the market. This suggests a similar consolidation might occur in the AI space. (22m9s)

- The discussion highlights a significant platform shift, emphasizing that foundational layer AI companies are poised to become some of the most valuable in history. These companies will serve as the base for various applications, similar to how mobile operating systems function. (22m41s)

Current Investments and Creative Industry Transformation

- Current investments are focused on application layers that enhance efficiency and infrastructure using AI, with companies transitioning from prompts to products. The value of these companies is currently unrealized. (23m9s)

- There is a transformation occurring in the creative industry due to AI, with concerns about AI models training on creative works without compensation or permission. This issue is particularly relevant to creatives and investors in AI. (23m45s)

- There is a focus on protecting and supporting talent in the face of AI advancements. Being involved with leading AI platforms allows for advocacy and ensuring the community's voice is heard in decision-making processes. (24m19s)

- Initial reactions to AI in the music community were negative, with fears of AI being detrimental. However, there is a unique opportunity to address and solve these challenges, with ongoing efforts to support talent and find solutions that benefit all parties. (25m25s)

- The rapid development of AI models, often based on community content, is largely unregulated, leading to chaos. Efforts are being made to address these issues, with some expected to be resolved legally. (26m1s)

Widespread AI Adoption and Human Enhancement

- Many companies are working to make their products affordable and offer free options, ensuring everyone has access to these tools, particularly AI, which is seen as a crucial aspect of innovation (26m37s).

- The widespread adoption of AI is expected to enhance human capabilities, rather than replace them, making people more prolific in their work than they could have been historically (27m8s).

- The introduction of AI is compared to previous innovations like the personal computer, the car, and the industrial revolution, which initially sparked fear but ultimately led to significant progress (27m55s).

- AI is viewed as a tool that can help humans solve global problems, such as saving the planet and using resources more effectively (28m33s).

- The current state of AI development is likened to the early days of Napster, which was initially met with resistance but ultimately led to the creation of new products like Spotify (28m52s).

- The music industry's experience with Spotify serves as an example of how new technologies can both benefit and challenge traditional business models, with the platform bringing in significant revenue but also making it harder for some musicians to earn a living (29m39s).

- The music industry's shift towards streaming has created new opportunities for artists, but also presents challenges, particularly for those signed to record labels with unfavorable deals (30m20s).

Investing in Large Action Models and Future Vision

- There is excitement about investing in companies that focus on large action models, which can learn user preferences and act on their behalf, potentially disrupting major players like Apple. The focus is more on software than hardware. (30m33s)

- The vision for the future includes agents that can intuitively perform tasks for users, similar to how operating systems function. This could lead to significant changes in how hardware and app ecosystems operate. (31m40s)

- There is interest in companies like Humane, which are exploring new possibilities in AI and hardware. The belief is that a breakthrough in this space will be powerful and impactful. (33m10s)

Support for Individuals in AI

- There is admiration and support for individuals like Johnny and Sam, who are seen as talented and kind, with a willingness to support their endeavors. (33m34s)