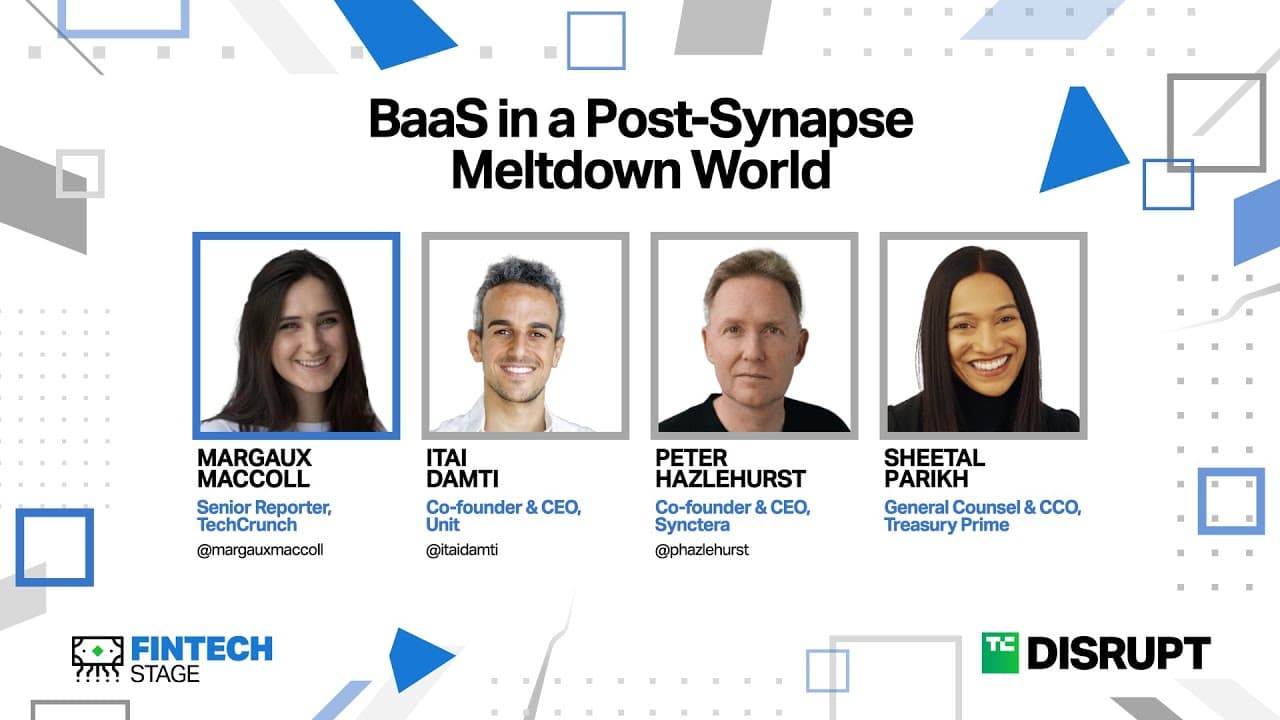

Post-Synapse meltdown, this is the state of the banking-as-a-service industry | TC Disrupt 2024

29 Oct 2024 (1 year ago)

Synapse's Bankruptcy and the Future of Banking-as-a-Service

- Synapse Financial Technologies, a banking-as-a-service company, filed for bankruptcy, leaving millions of dollars in customer assets frozen with no clear timeline for recovery. (25s)

- The issues leading to Synapse's downfall were attributed to a combination of factors, primarily a breakdown in technology related to reconciliation and communication between Synapse, its fintech partners, and the partner bank. (1m6s)

- The future of banking-as-a-service is expected to involve more companies expanding from software to financial services, offering opportunities to serve businesses, individuals, and independent workers. (2m24s)

- There is significant potential for integrating banking services into various applications, allowing businesses to manage finances more efficiently by keeping money closer to their operations. (3m3s)

- The main obstacle to achieving this integrated financial ecosystem is regulatory uncertainty, which poses challenges to the development and implementation of banking-as-a-service solutions. (3m48s)

- The current state of the banking-as-a-service industry is being judged by anomalies, such as the Synapse dispute, rather than the overall potential and opportunities within the space. There is significant synergy between community banks and tech companies, which is crucial for the survival and growth of these banks through partnerships and innovation in their product offerings. (3m59s)

Misconceptions, Oversight, and Regulatory Challenges

- A common misconception is that the technology lacks controls and that end-user funds are unsafe. However, it is possible to build responsible innovations that adhere to regulations, as demonstrated by numerous bank partners who engage proactively with regulators. (4m36s)

- Companies have solved the initial challenges of helping people open bank accounts, issue cards, and move money through APIs. The focus is now shifting towards oversight, ensuring that bank partners have visibility into the operations, marketing, fees, and fraud management of tech companies they work with. (5m13s)

- The future of the industry involves building oversight capabilities, which are currently under-discussed. Regulators can assist by treating fintech companies the same as traditional banks, ensuring consistent checks and balances, starting with KYC and identity verification. (6m7s)

- The Synapse breakdown highlighted issues with data access and third-party ledgers. It is essential for banks to have direct visibility and connectivity into transactional data, similar to their core bank accounts, to satisfy regulatory requirements. (6m51s)

Evolution of Banking-as-a-Service and the Need for Transparency

- In 1995, fintech platforms created "Branch zero," an internet branch, to simplify banking processes and ensure consistent customer treatment across channels. The focus was on making banking processes transparent and ensuring data backups and safe data transfer methods. (7m30s)

- The current banking-as-a-service industry aims to replicate traditional banking capabilities while addressing regulatory concerns about increased scale and potential fraud. This is particularly relevant when small banks open up to a larger customer base through technology, which can significantly increase their customer volume. (8m29s)

- Banks now demand greater transparency and real-time updates from fintech platforms, moving away from a model of blind trust. This shift is driven by the need to understand the underlying processes and ensure compliance with regulatory standards. (9m35s)

Scalability, Fraud, and Regulatory Scrutiny

- The scalability of banking services is a major challenge, as traditional processes do not scale well with the increased volume of digital customers. Technology and automation are essential to handle this growth effectively. (10m8s)

- The rise of digital banking has introduced new fraud vectors and financial crime patterns, prompting regulators to focus on both tactical and operational aspects of banking services. Banks are scrutinized on their entry into the digital space and their strategies for profitability and compliance. (10m38s)

- Regulators are emphasizing the importance of banks being deliberate and getting buy-in from the highest levels, including the board of directors and senior executives, due to the drastic changes in how banking products are consumed (11m7s).

Transparency and Structures in Banking-as-a-Service

- The lack of transparency in banking-as-a-service structures can lead to end-users being unaware of which bank is holding their money, as seen in the case of Snap (11m32s).

- There are two types of structures in the industry: one used by Synapse, which utilizes broker-dealer licenses to stand between the bank and end-users, and another that makes banks the creators of deposit accounts, requiring clear disclosure of the bank's name (12m4s).

- Even with clear disclosure, end-users may still be unaware of the underlying bank, emphasizing the need for education and transparency (12m50s).

- Banks and fintech companies are required to disclose their partnership and have a deposit agreement, with regulators honing in on the need for clear boundaries between banks and tech firms (14m1s).

Banking Partner Selection and Regulatory Oversight

- When selecting a banking partner, fintech companies should look for factors such as financial stability, but the vetting process is not fully discussed in the provided text (14m26s).

- Regulators, such as Mike Sue from the OCC, view the relationship between banks and fintech companies as a supply chain, requiring clear disclosure and boundaries (13m52s).

- The importance of transparency and disclosure is emphasized, with the suggestion that consumers should be cautious of banking services that do not clearly disclose the underlying bank (13m31s).

Importance of Long-Term Bank Partnerships and Due Diligence

- The importance of selecting banks committed to long-term investment in the banking-as-a-service industry is emphasized, as these banks are willing to incur initial losses for future profitability through investments in software, partners, and processes. (14m39s)

- Successful bank partners, such as those working with Treasury Prime, demonstrate investment and alignment across all levels, from innovation to compliance teams, ensuring a unified approach to partnerships. (15m39s)

- Establishing strong, long-term relationships with bank partners is crucial, and face-to-face meetings are prioritized to understand the bank's intentions and business opportunities. (16m20s)

- There is a shift towards more conservative structuring of accounts and relationships due to changing interest rates, highlighting the importance of knowing one's partners well. (16m46s)

- Decisions to not partner with certain banks are based on factors such as the bank's asset size, understanding of growth strategies, and potential contagion risk from working with multiple fintech partners. (17m23s)

- Concerns exist about one problematic program potentially damaging relationships with banks, leading to consent orders affecting all programs associated with that bank. Efforts are made to maintain clean and focused operations without imposing exclusivity, as it is believed to be easier to control and manage. (17m57s)

- When vetting banks, it is important to engage with the bank's board to ensure they ask intelligent questions and understand future product visions. Boards at community banks are often seen as outdated, but partnerships are built with those who resonate with future products. (18m28s)

- A bank can be disqualified if its compliance officer does not thoroughly question controls and reports, indicating a lack of sophistication to handle regulatory exams and operate at scale. (18m57s)

- The level of investment from banks is gauged not just by financial resources but also by the number of people and operational plans. Banks interested only in acquiring deposits without further investment are seen as red flags. (19m13s)

Building Trust and Transparency with Banks and Consumers

- Trust must be earned from both banks and consumers. Scale, serving over 1.6 million end users and having completed audits and certifications, helps build confidence. External certifications are crucial in establishing initial trust in the absence of stable brands. (19m59s)

- Trust is further built by standing by commitments, being responsive to issues, and acknowledging mistakes. Transparency and empathy are essential, especially when dealing with consumers' money, as their lives are impacted if they cannot access their funds. (20m45s)

- The aftermath of Synapse's issues has negatively impacted real people, highlighting the importance of considering the human element in banking services. Transparency is crucial for establishing trust, and companies should be honest about incidents on their status pages. (21m20s)

- Establishing clear roles and responsibilities among technology partners, bank partners, and financial technology companies (finex) is essential for building trust in the banking-as-a-service ecosystem. Treasury Prime acts as a technology partner, while banks and finex serve as touchpoints with end customers. (22m1s)

The Bank Operating System and Partnership Strategies

- The concept of a "Bank operating system" is emphasized, where banks embed tools for their own programs and deposits, making banking-as-a-service more than just fintech partnerships. This approach is seen as necessary for staying relevant in the industry. (22m34s)

- Convincing banks to partner without a track record is challenging. A unique approach of 50/50 revenue sharing was used to build market supply, ensuring both success and failure are shared. Economic alignment and trust are key factors in these partnerships. (23m1s)

- The importance of having experienced professionals in compliance, operations, and engineering is highlighted, as many challenges arise from those unfamiliar with the industry. Building banking infrastructure in 2024 is expected to be even more difficult due to the complexities involved. (24m12s)

- The company moves over $40 billion annually and initially started with just two people and $3.6 million in the bank, trying to convince banks to build an operating system to partner with tech companies during the onset of COVID-19. (24m39s)

- Early efforts included offering equity to the first banks that partnered with them, which helped establish initial relationships, though it's uncertain if this approach would be effective in today's regulatory environment. (25m14s)

Challenges and Barriers to Entry in Banking-as-a-Service

- There is a suggestion to discourage new companies from entering the banking-as-a-service industry, as existing companies like Unit, Synctera, and Treasury Prime already provide necessary solutions, reducing the need to reinvent the wheel. (25m43s)

- Building a company in this space is described as a $100 million problem, with the need for investors who can support the financial journey, as initial funding estimates often fall short. (26m19s)

- Challenges for fintech companies include a heavy focus on technology without sufficient investment in understanding the regulatory landscape, which is crucial for dealing with people's money and data. (26m56s)

- Banks are selective about partnering with fintechs, preferring those with an established track record, mission-based values, and a cultural fit with the bank. (27m45s)

Long-Term Commitment and the Nature of Infrastructure Businesses

- To succeed in the banking-as-a-service industry, it is crucial to have certain foundational elements well-established, particularly when partnering with banks. (28m2s)

- Building a successful infrastructure business typically requires a long-term commitment of 10 to 20 years, as opposed to the rapid growth often expected in Silicon Valley. (28m11s)

- Infrastructure companies need to prove their ability to operate at scale, build a brand, gain trust, obtain certifications, and secure large customers and revenues over time. (28m30s)

- This long-term approach is necessary for various types of infrastructure, including payroll, accounting, and insurance, and requires a passion for solving complex, often mundane problems. (28m48s)

- The financial growth of infrastructure businesses is characterized by compounding over a decade or more, rather than achieving quick success. (29m5s)