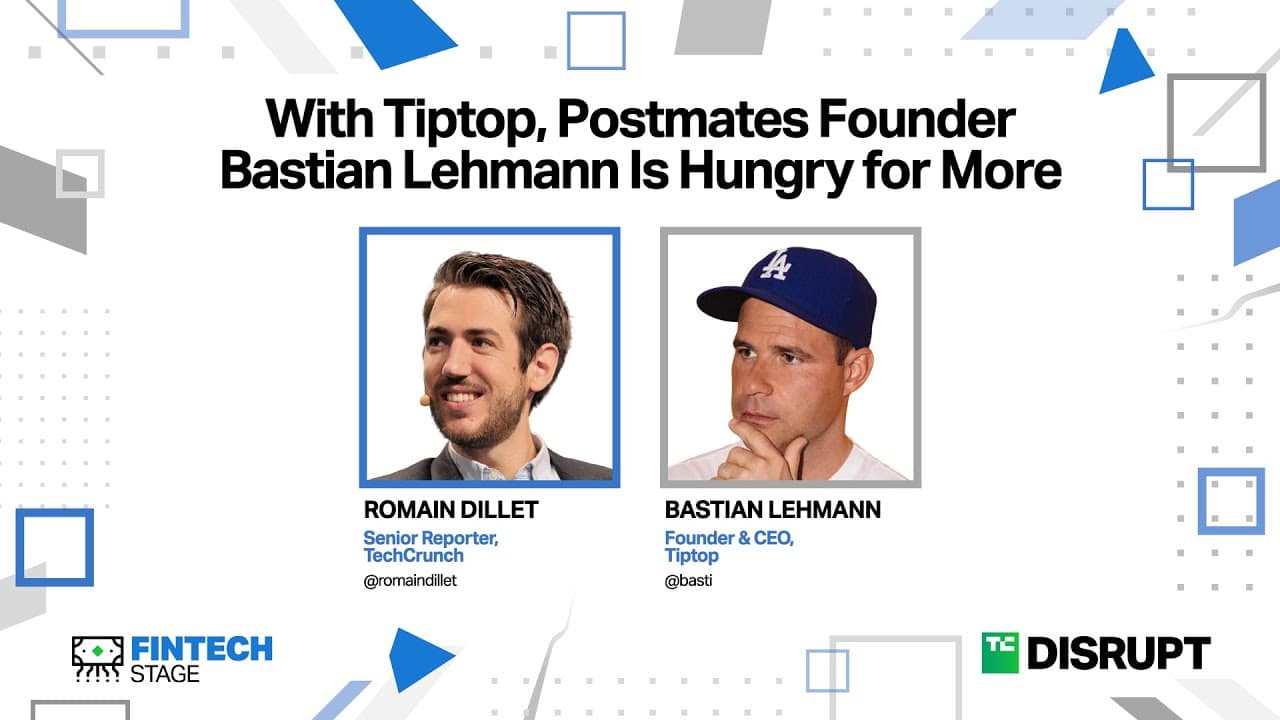

Postmates founder Bastian Lehmann is hungry for more with fintech Tiptop | TechCrunch Disrupt 2024

29 Oct 2024 (1 year ago)

Tiptop: A New Approach to Trade-Ins

- Bastian Lehmann, known for founding Postmates, discusses the importance of approaching new business ideas with an open mind rather than setting rigid goals, as ideas are fragile in their early stages. (29s)

- Lehmann is now working on a new startup called Tiptop, which aims to innovate the trade-in process by offering instant payment for traded items and integrating this process at the point of purchase to make transactions more affordable. (1m22s)

- Tiptop's approach does not directly compete with existing payment systems but offers unique features that other systems do not provide, such as immediate compensation for trade-ins. (2m28s)

- The company simplifies the trade-in process by allowing users to drop off items at UPS or have them picked up by Uber, eliminating the need for traditional packaging and shipping methods. Once received, items are assessed and sold through a network of partners. (3m23s)

- Tiptop was initially thought to be a crypto company when it was founded in 2022, but Lehmann clarifies that this was not the intended direction. (4m9s)

- Initially, there was an idea to use blockchain as a ledger of record for item ownership, creating a certificate on the chain to serve as a ledger of truth for reselling items. This concept was considered particularly interesting for high-value items like luxury watches and cars, but not as valuable for consumer electronics. (4m26s)

- The focus shifted from the blockchain ledger idea to the actual buying and selling process, with uncertainty about whether the ledger concept would be reintroduced if Tiptop succeeds. (5m36s)

From Postmates to Tiptop: The Founder's Journey

- Postmates initially started with a different concept before pivoting to food delivery, which became a mainstream success. This ability to pivot and adapt is seen as a key aspect of the founder's style. (5m48s)

- In a startup, the role of a CEO or founder involves testing various hypotheses quickly and making decisions based on feedback and learning from the market. This often requires pivoting and adapting to new insights. (6m30s)

- The first iteration of Tiptop was an app that allowed users to easily convert items into cash, which was successful. However, it was discovered that most people prefer to trade in items when purchasing something new, leading to integration at the checkout. (7m46s)

- After selling Postmates to Uber, Bastian Lehmann decided to start a new company because he finds creating and putting ideas into the world incredibly exciting and rewarding. He compares this creative process to being an artist, although he acknowledges that his skills lie in building products rather than in the arts. (8m42s)

- Lehmann acknowledges that there is pressure in starting a new company, similar to a sports team wanting to win a championship again. Despite this pressure, he finds the process rewarding and is motivated by the potential to change things and create tools for others. (10m0s)

- Lehmann reflects on the challenges of starting a new company after having a successful one. He notes that having prior knowledge can sometimes be a disadvantage because it may lead to overthinking and avoiding risks. He suggests that maintaining a childlike mindset can be beneficial in decision-making. (10m46s)

- Lehmann admits that his background and connections made it easier to raise funds for his new company, Tiptop. He acknowledges that this ease of fundraising adds to the pressure but does not necessarily provide an unfair advantage. The company, Tiptop Lab, is designed to allow room for innovation and exploration of multiple ideas. (11m49s)

Tiptop's Business Model and Market Potential

- Bastian Lehmann discusses his preference for consumer-focused ideas, despite the challenges and capital requirements, as opposed to B2B companies. He finds the concept of Tiptop, which allows trading items when purchasing new ones, intriguing and challenging. (13m25s)

- Tiptop has created a catalog of 50,000 items for which they offer instant cash, estimating the value of consumer goods in U.S. households at around $280 billion, or $1,600 per household. This is likened to a hidden bank account that Tiptop aims to unlock for consumers. (14m39s)

- The business model of Tiptop involves initially compressed margins due to the need to process payments and buy and sell items. Revenue is generated by charging merchants to join the platform and potentially through margins on selling or reselling items. (15m44s)

- Tiptop has a growing base of merchants, including companies like Nothing, known for its Android phone, Drone Nerds for robotics and drones, and King of Christmas for holiday products. The focus is on deep integration with these merchants to deliver meaningful volume. (16m27s)

- Tiptop, a fintech company, is being considered for use by major consumer electronics companies like Apple, which currently uses the Postmates API for same-day delivery services. (17m28s)

Beyond Tiptop: Investments and Venture Capital

- Bastian Lehmann, the founder of Postmates, is actively investing in startups and venture capital funds, alongside his friend and former COO of Postmates, VI Patel. They have made around 40 investments and are in the process of raising their first fund called ILM YLEEM. (18m11s)

- One of Lehmann's notable investments is in a company called Zellerf, which specializes in 3D printing shoes. This company collaborates with brands like Nike and allows designers to create and sell shoes directly on their marketplace, bypassing traditional middlemen. (18m52s)

- Zellerf's innovative 3D printing technology uses a material similar to Flyknit, allowing for the creation of non-toxic and environmentally friendly shoes. The company has worked with high-profile brands such as Louis Vuitton, Balenciaga, and has attracted interest from Kanye West. (19m31s)

- Founders Fund recently participated in Zellerf's latest funding round, highlighting the company's potential and success in the market. (20m36s)

- There is a problem in Silicon Valley where many venture capitalists tend to outsource decision-making and chase the same deals, leading to a lack of successful funds despite the large number of them. (21m17s)

- Many venture capitalists do not listen and instead try to categorize founders based on patterns, which results in overlooking remarkable companies and founders who do not fit these patterns. (21m58s)

- Historically, extremely successful companies often appeared unlikely to succeed initially, and few investors would have backed them at the start. Postmates is an example of such a company that struggled to raise its Series A funding. (22m32s)

- Founders Fund, which invested in Postmates, is known for its contrarian approach, although this concept has become overused and lost its meaning among venture capitalists. (23m21s)

Final Thoughts: From Germany to the U.S. and Election Fatigue

- Bastian Lehmann, who grew up in Germany, relocated to the United States about 15 years ago and believes it was a good decision. He advises international entrepreneurs with talent and ambition to consider building their companies in the U.S. (23m44s)

- Lehmann expresses a sense of fatigue regarding the upcoming election due to the overwhelming number of ads, phone calls, and text messages. (24m31s)